This thread is sort of related to the thread about choosing a Rendezvous destination for 2020, nominally the year we would all happily meet again in BC waters. Kathy and I are eager to return, but a financial problem has cropped up.

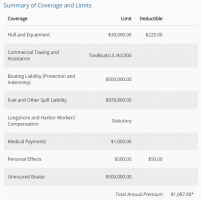

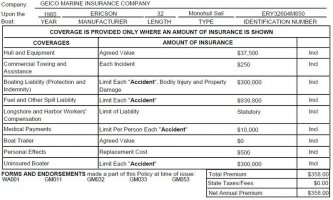

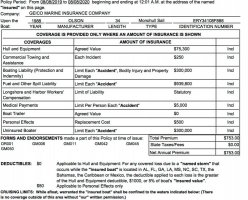

I first became aware of a major change in required insurance for visiting boats when some of our club members visited Maple Bay YC in 2018 are were cautioned that their usual proof of insurance would have to document a 2 million $ liability coverage by 2020.

The reciprocal moorage person at MBYC assures me that this new minimum is being implemented for all clubs and marinas in BC waters for next year. I have asked her WHY the change from the usual 300K or even 500K, and she dodges the question and never answers.

So our club's Reciprocal Moorage chair got involved and sought guidance from the folks that own the web site for information on all NW reciprocals.

Here is an excerpt from his email to me today:

"Well, I’ve done a bit of research since I got home and the information I found is not encouraging in terms of increased premiums to meet the $2,000,000. requirement that British Columbia is implementing.

I called Bob Brunis, of Yacht Destinations, and he told me that this is the direction things are going in BC. He is going to try and list, in the “Terms" section of each reciprocal club on YD, the insurance requirement that they will insist upon in 2020.

There is also a question that perhaps the requirement above $1,000,000. can be provided with proof of insurance with an Umbrella Policy, but you must make sure your boat or yacht is included in the Umbrella description coverage."

Link: https://yachtdestinations.org/forums/index.php?app=frontpage

I have contacted my insurer, BoatUS, and this coverage would cost me an additional $80. a year. (My friend that handles our club's reciprocal's also checked what the increase would be for his 32 foot trawler, and was quoted $400./year.

Yikes.

I suppose that we can all wonder if several BC marina's were destroyed in recent years caused by visiting boats that burst into flames.... but it seems like a catastrophe of such gargantuan proportions would have been in the news.

By comparison, our 150-boat yacht club moorage (Rose City YC) requires only proof of insurance and has not specified any minimum liability amount. Most of the policies seem to be at 300K or 500K and a handful have all of their insurances thru one carrier with a 1 million $ umbrella coverage on everything. In my capacity as Port Captain I see copies of these policies regularly, and know this to be factual. OF course our club has a hefty umbrella policy for the whole facility,

I can imagine that a lot of smaller US boats will start choosing to either anchor out when going north or just not going. Perhaps.

And yes, cruising a boat was never a cheap activity, but like all retirees we have to watch our budget when vacationing. This would seem to do nothing for the marinas but will enrich some large insurance companies, if a touch of cynicism is allowed.

Or.... the marinas, public and private, just want to winnow out the "less financially endowed" boaters. Like us.

This may affect participation of US boats in any cruising or rendezvous in BC waters, as much as we all LOVE to visit there.

Plus, how can BC boaters afford to tie up in their own local marinas??

If any of you know folks in the marine insurance business, please ask them what is causing this.

Thanks so much.

I first became aware of a major change in required insurance for visiting boats when some of our club members visited Maple Bay YC in 2018 are were cautioned that their usual proof of insurance would have to document a 2 million $ liability coverage by 2020.

The reciprocal moorage person at MBYC assures me that this new minimum is being implemented for all clubs and marinas in BC waters for next year. I have asked her WHY the change from the usual 300K or even 500K, and she dodges the question and never answers.

So our club's Reciprocal Moorage chair got involved and sought guidance from the folks that own the web site for information on all NW reciprocals.

Here is an excerpt from his email to me today:

"Well, I’ve done a bit of research since I got home and the information I found is not encouraging in terms of increased premiums to meet the $2,000,000. requirement that British Columbia is implementing.

I called Bob Brunis, of Yacht Destinations, and he told me that this is the direction things are going in BC. He is going to try and list, in the “Terms" section of each reciprocal club on YD, the insurance requirement that they will insist upon in 2020.

There is also a question that perhaps the requirement above $1,000,000. can be provided with proof of insurance with an Umbrella Policy, but you must make sure your boat or yacht is included in the Umbrella description coverage."

Link: https://yachtdestinations.org/forums/index.php?app=frontpage

I have contacted my insurer, BoatUS, and this coverage would cost me an additional $80. a year. (My friend that handles our club's reciprocal's also checked what the increase would be for his 32 foot trawler, and was quoted $400./year.

Yikes.

I suppose that we can all wonder if several BC marina's were destroyed in recent years caused by visiting boats that burst into flames.... but it seems like a catastrophe of such gargantuan proportions would have been in the news.

By comparison, our 150-boat yacht club moorage (Rose City YC) requires only proof of insurance and has not specified any minimum liability amount. Most of the policies seem to be at 300K or 500K and a handful have all of their insurances thru one carrier with a 1 million $ umbrella coverage on everything. In my capacity as Port Captain I see copies of these policies regularly, and know this to be factual. OF course our club has a hefty umbrella policy for the whole facility,

I can imagine that a lot of smaller US boats will start choosing to either anchor out when going north or just not going. Perhaps.

And yes, cruising a boat was never a cheap activity, but like all retirees we have to watch our budget when vacationing. This would seem to do nothing for the marinas but will enrich some large insurance companies, if a touch of cynicism is allowed.

Or.... the marinas, public and private, just want to winnow out the "less financially endowed" boaters. Like us.

This may affect participation of US boats in any cruising or rendezvous in BC waters, as much as we all LOVE to visit there.

Plus, how can BC boaters afford to tie up in their own local marinas??

If any of you know folks in the marine insurance business, please ask them what is causing this.

Thanks so much.

Last edited: